E D U C A T I O N

ADVANCE CARE PLANNING

A D V A N C E C A R E P L A N N I N G

Advance Care Planning: Care Instructions

Your Care Instructions

It can be hard to live with an illness that cannot be cured. But if your health is getting worse, you may want to make decisions about end-of-life care. Planning for the end of your life does not mean that you are giving up. It is a way to make sure that your wishes are met. Clearly stating your wishes can make it easier for your loved ones. Making plans while you are still able may also ease your mind and make your final days less stressful and more meaningful.

Follow-up care is a key part of your treatment and safety. Be sure to make and go to all appointments, and call your doctor if you are having problems. It's also a good idea to know your test results and keep a list of the medicines you take.

What can you do to plan for the end of life?

- You can bring these issues up with your doctor. You do not need to wait until your doctor starts the conversation. You might start with "I would not be willing to live with ...." When you complete this sentence it helps your doctor understand your wishes.

- Talk openly and honestly with your doctor. This is the best way to understand the decisions you will need to make as your health changes. Know that you can always change your mind.

- Ask your doctor about commonly used life-support measures. These include tube feedings, breathing machines, and fluids given through a vein (IV). Understanding these treatments will help you decide whether you want them.

- You may choose to have these life-supporting treatments for a limited time. This allows a trial period to see whether they will help you. You may also decide that you want your doctor to take only certain measures to keep you alive. It is important to spell out these conditions so that your doctor and family understand them.

- Talk to your doctor about how long you are likely to live. He or she may be able to give you an idea of what usually happens with your specific illness.

- Think about preparing papers that state your wishes. This way there will not be any confusion about what you want. You can change your instructions at any time.

Which papers should you prepare?

Advance directives are legal papers that tell doctors how you want to be cared for at the end of your life. You do not need a lawyer to write these papers. Ask your doctor or your state health department for information on how to write your advance directives. They may have the forms for each of these types of papers. Make sure your doctor has a copy of these on file, and give a copy to a family member or close friend.

- Consider a do-not-resuscitate order (DNR). This order asks that no extra treatments be done if your heart stops or you stop breathing. Extra treatments may include electrical shock to restart your heart or a machine to breathe for you. If you decide to have a DNR order, ask your doctor to explain and write it. Place the order in your home where everyone can easily see it.

- Consider a living will. A living will explains your wishes in case you are in a coma or cannot communicate. Living wills tell doctors to use or not use treatments that would keep you alive. You must have one or two witnesses or a notary present when you sign this form.

- Consider a durable power of attorney. This allows you to name a person to make decisions about your care if you are not able to. Most people ask a close friend or family member. Talk to this person about the kinds of treatments you want and those that you do not want. Make sure this person understands your wishes. If this person is not the health care agent named in your advance directive, also talk with your health care agent.

These legal papers are simple to change. Tell your doctor what you want to change, and ask him or her to make a note in your medical file. Give your family updated copies of the papers.

Advance Directives: Care Instructions

Your Care Instructions

An advance directive is a legal way to state your wishes at the end of your life. It tells your family and your doctor what to do if you can no longer say what you want. There are two main types of advance directives. You can change them any time that your wishes change.

- A living will tells your family and your doctor your wishes about life support and other treatment.

- A medical power of attorney lets you name a person to make treatment decisions for you when you can't speak for yourself. This person is called a health care agent.

- If you do not have an advance directive, decisions about your medical care may be made by a doctor or a judge who doesn't know you.

It may help to think of an advance directive as a gift to the people who care for you. If you have one, they won't have to make tough decisions by themselves.

Follow-up care is a key part of your treatment and safety. Be sure to make and go to all appointments, and call your doctor if you are having problems. It's also a good idea to know your test results and keep a list of the medicines you take.

How can you care for yourself at home?

- Discuss your wishes with your loved ones and your doctor. This way, there are no surprises.

- Many states have a unique form. Or you might use a universal form that has been approved by many states. This kind of form can sometimes be completed and stored online. Your electronic copy will then be available wherever you have a connection to the Internet. In most cases, doctors will respect your wishes even if you have a form from a different state.

- You don't need a lawyer to do an advance directive. But you may want to get legal advice.

- Think about these questions when you prepare an advance directive:

- Who do you want to make decisions about your medical care if you are not able to? Many people choose a family member, close friend, or doctor.

- Do you know enough about life support methods that might be used? If not, talk to your doctor so you understand.

- What are you most afraid of that might happen? You might be afraid of having pain, losing your independence, or being kept alive by machines.

- Where would you prefer to die? Choices include your home, a hospital, or a nursing home.

- Would you like to have information about hospice care to support you and your family?

- Do you want to donate organs when you die?

- Do you want certain religious practices performed before you die? If so, put your wishes in the advance directive.

- Read your advance directive every year, and make changes as needed.

When should you call for help?

Be sure to contact your doctor if you have any questions.

National Hospice and Palliative Care Organization

Care instructions adapted under license by Alliance In Health Diabetes Control Center. This care instruction is for use with your licensed healthcare professional. If you have questions about a medical condition or this instruction, always ask your healthcare professional. Healthwise, Incorporated disclaims any warranty or liability for your use of this information.

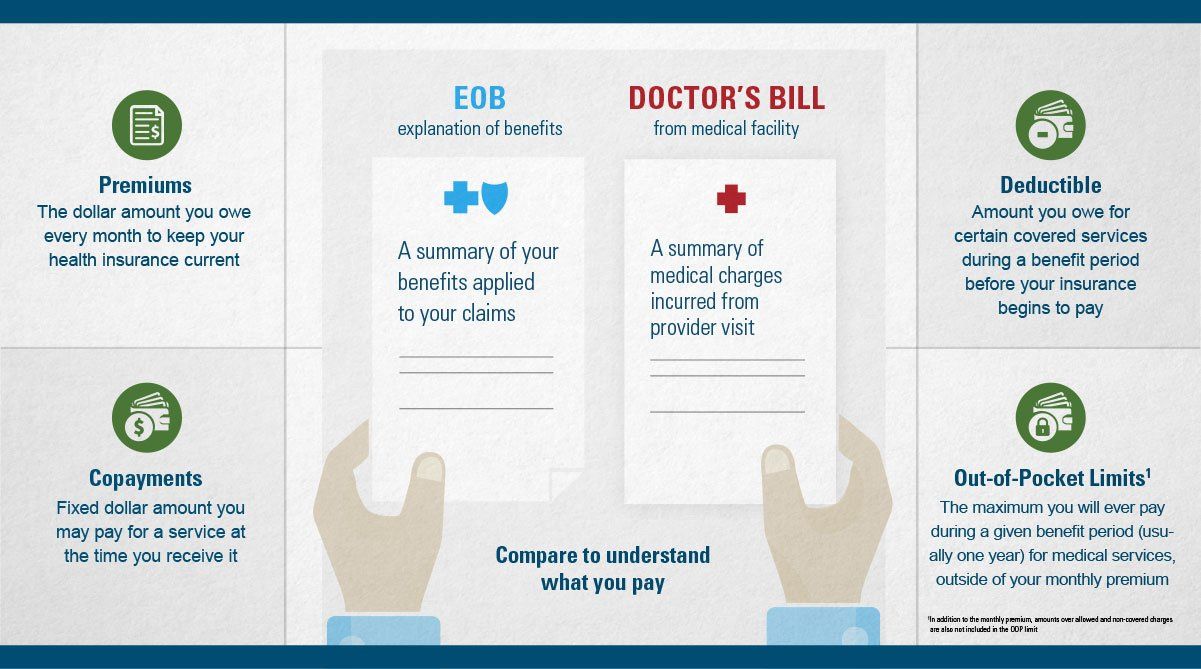

Deductibles, Coinsurance and Maximum Limits

Example #1: Deductibles, Coinsurance and Out-of-Pocket Maximum

You have an insurance plan that has a:

$5,000 deductible

20% coinsurance

Out-of-pocket maximum of $6,000

This means:

You must pay the first $5,000 of your medical costs.

After that, your plan covers 80% of the costs, and you pay the other 20%.

When the amount of coinsurance you've paid reaches $6,000, the plan covers 100% until your "plan year" renews. A plan is good for 1 year.

At the start of each year, your deductible and coinsurance resets for the next plan year and the $5,000 deductible and 20% coinsurance will start again.

Example #2: Coinsurance After You've Met Your Deductible

You bruise your hip in a fall and you need an X-ray. You've met your annual $5,000 deductible so your plan now pays for benefits. What you pay to see your doctor depends on your coinsurance, which in our example, is 20%.

Here's how the costs might break down:

The X-ray costs $200.

Your plan covers 80%, which is $160.

Your out-of-pocket cost, or coinsurance, is $40.

Example #3: Maximum Limits

Your plan covers up to a certain amount for tests, procedures and medical services. These limits help keep rates fair and reasonable, which helps lower costs for all members.

Let's say your doctor charges more for an X-ray.

Your plan covers a maximum of $200 for an X-ray.

Your doctor charges $300.

You may have to pay the $100 difference.

This is for informational and educational purposes only and does not supersede or replace your insurnace benefit booklet. All benefit determinations will be based on the terms described in your insurance benefit booklet.